Trade-off between entropy and Gini Index in income distribution

D. Koutsoyiannis, and G.-F. Sargentis, Trade-off between entropy and Gini Index in income distribution, Entropy, 28 (1), 35, doi:10.3390/e28010035, 2026.

[doc_id=2583]

[English]

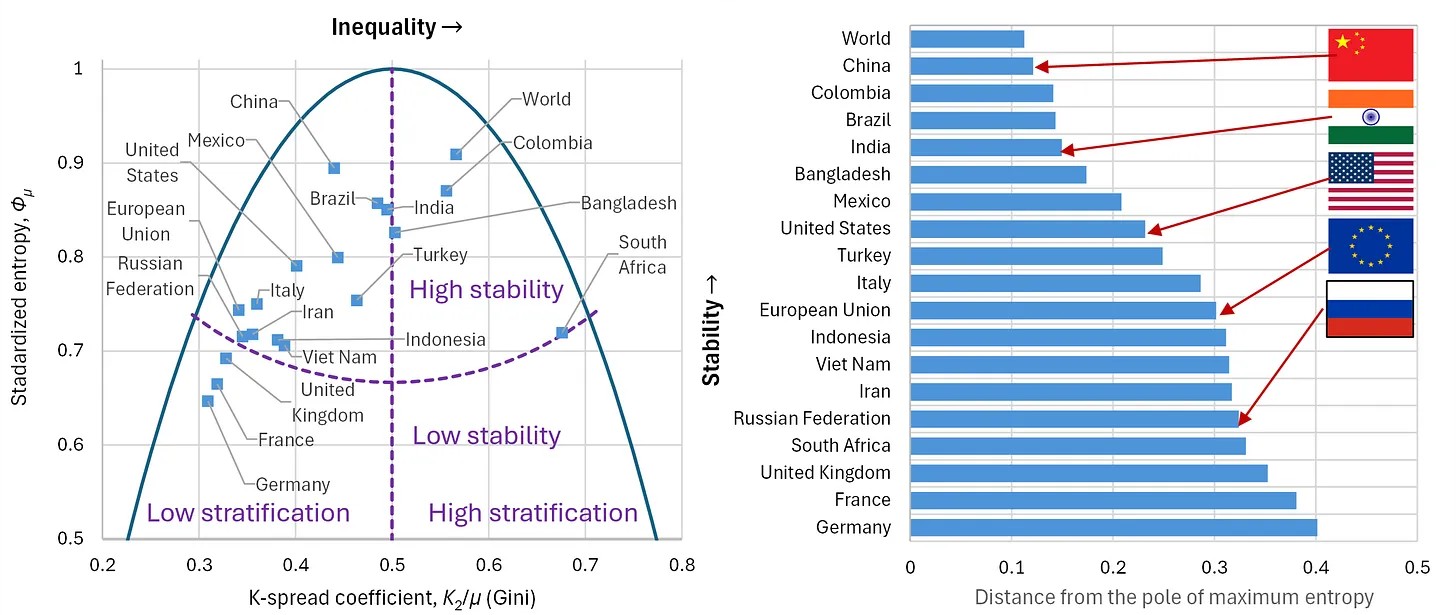

We investigate the fundamental trade-off between entropy and the Gini index within income distributions, employing a stochastic framework to expose deficiencies in conventional inequality metrics. Anchored in the principle of maximum entropy (ME), we position entropy as a key marker of societal robustness, while the Gini index, identical to the (second-order) K-spread coefficient, captures spread but neglects dynamics in distribution tails. We recommend supplanting Lorenz profiles with simpler graphs such as the odds and probability density functions, and a core set of numerical indicators (K-spread K₂/μ, standardized entropy Φμ, and upper and lower tail indices, ξ, ζ) for deeper diagnostics. This approach fuses ME into disparity evaluation, highlighting a path to harmonize fairness with structural endurance. Drawing from percentile records in the World Income Inequality Database from 1947 to 2023, we fit flexible models (Pareto–Burr–Feller, Dagum) and extract K-moments and tail indices. The results unveil a concave frontier: moderate Gini reductions have little effect on entropy, but aggressive equalization incurs steep stability costs. Country-level analyses (Argentina, Brazil, South Africa, Bulgaria) link entropy declines to political ruptures, positioning low entropy as a precursor to instability. On the other hand, analyses based on the core set of indicators for present-day geopolitical powers show that they are positioned in a high stability area.

Tagged under: Entropy, Stochastics